Car finance or lease which is better has become a hot topic in 2026 as drivers face higher vehicle prices, rising interest rates, and new options in the electric car market. Many people wonder whether it’s smarter to finance a car and eventually own it or to lease one for a few years and return it. This report takes a closer look at both options, comparing benefits, drawbacks, and what industry experts are saying.

Car Finance or Lease: What It Means for Drivers

When people talk about car finance, they usually mean taking a loan to purchase a vehicle. You make monthly payments to a bank, credit union, or dealership until the loan is fully paid. Once that happens, the car is yours. Leasing, on the other hand, is more like a long-term rental. You pay a set monthly fee for a fixed term, usually two to four years, and then return the vehicle unless you decide to buy it at the end.

Both approaches have their own advantages, and both come with challenges. Let’s break them down.

Car Loan Apply – Eligibility Criteria

Car Finance or Lease – What Is Car Finance?

Car finance is the traditional way to buy a car without paying the full amount upfront. You agree on a loan amount, an interest rate, and a repayment schedule. At the end of the loan, you own the car outright.

Why many drivers prefer financing

- Ownership at the end of the loan.

- No mileage limits or penalties.

- Freedom to sell, trade, or modify the car.

- Builds equity as you pay down the loan.

Challenges of financing

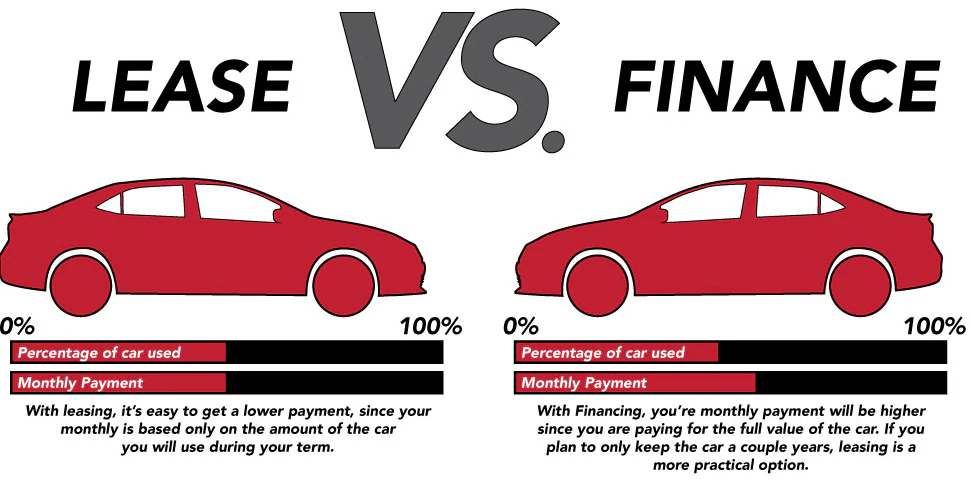

- Higher monthly payments compared to leasing.

- The car’s value drops over time, and you take the hit.

- Once the warranty ends, you cover all repair costs.

- Loan interest increases the total expense.

Example: Financing a $35,000 SUV over five years may cost about $650 per month. When the loan is finished, you own the SUV, though it may only be worth $18,000.

Car Finance or Lease – What Is Leasing?

Leasing works differently. You don’t own the car, but you get to use it for a few years with lower monthly payments. At the end of the term, you either return the car, upgrade to a new one, or sometimes buy it for a set price.

Why many drivers lease

- Lower monthly payments than financing.

- Ability to drive a new model every few years.

- Often includes warranty coverage.

- Lower upfront costs.

Challenges of leasing

- No ownership at the end unless you buy the car.

- Strict mileage limits, often 10,000–15,000 miles a year.

- Fees for excess wear and tear.

- Leasing repeatedly may cost more than buying.

Example: Leasing that same $35,000 SUV might cost $420 per month. At the end of three years, you return it with no asset to show for the payments.

Car Finance or Lease Which Is Better: Direct Comparison

Here’s a side-by-side look at how the two choices compare in 2025:

| Factor | Car Finance | Car Lease |

|---|---|---|

| Ownership | Yours after loan ends | Returned at lease end |

| Monthly Payment | Higher | Lower |

| Mileage | Unlimited | Limited (10k–15k/year) |

| Flexibility | Sell, keep, or modify anytime | Must follow lease terms |

| Cost Over Time | Cheaper long-term | Cheaper short-term |

| Best For | Long-term drivers, high mileage | Short-term users, city drivers |

Car Finance or Lease – Monthly Payments Compared

Financing often costs $200–$300 more per month than leasing, but those payments build toward ownership. Leasing is easier on monthly budgets but doesn’t build equity.

Car Finance or Lease – Ownership and Flexibility

With financing, the car is fully yours after the loan. You can drive it as long as you like, sell it, or even pass it on. Leasing limits your options because the vehicle must be returned unless you buy it.

Car Finance or Lease – Cost Over Time

Leasing can be cost-effective for a few years, but if you keep leasing new cars, you’ll keep paying forever. Financing costs more upfront but saves money in the long run if you hold on to the vehicle.

Car Finance or Lease in 2025: Market Trends

In 2025, leasing has become especially popular among younger professionals in cities. They like the lower payments and the chance to drive the latest electric or hybrid cars without worrying about resale value.

According to industry analysts, about 40 percent of new vehicles in North America are leased, with electric vehicles leading the trend. Financing, however, is still more common overall, especially in suburban and rural areas where drivers travel more miles and prefer ownership.

Car Finance or Lease Which Is Better for Your Lifestyle?

Choosing between finance and lease depends on how you see your car.

- Choose finance if:

- You want long-term ownership.

- You drive more miles than the average lease allows.

- You don’t mind handling maintenance later.

- You see value in keeping a car for years.

- Choose lease if:

- You like lower payments.

- You prefer new models every few years.

- You don’t drive more than 10,000–15,000 miles a year.

- You want warranty coverage for peace of mind.

Simple rule: If you plan to keep a car for six years or more, financing is usually cheaper. If you want new features every few years, leasing may be the better option.

Expert Insights: Car Finance or Lease in Real Life

Experts say many people start out leasing when they are younger because it helps with cash flow and gives flexibility. Later, as they settle down and drive more, financing becomes the better fit.

Business owners often prefer leasing because payments can be written off as expenses. Individual buyers, however, often lean toward financing when they want to build value and avoid ongoing monthly obligations.