Let us be honest, money can get confusing. Between rising prices, changing jobs, and unexpected expenses, keeping track of your finances is harder than ever. I remember the days I scribbled numbers in notebooks and guessed what I could afford. It was frustrating, stressful, and—most of all—not very dependable.

Last year, I gave in and tried a financial health tool. It was a decision that changed my life in ways I did not expect. Suddenly, everything was clear: my spending, my savings, and where I could do better. That simple step of plugging my numbers into a financial health calculator gave me more control and confidence.

What Is a Financial Health Tool?

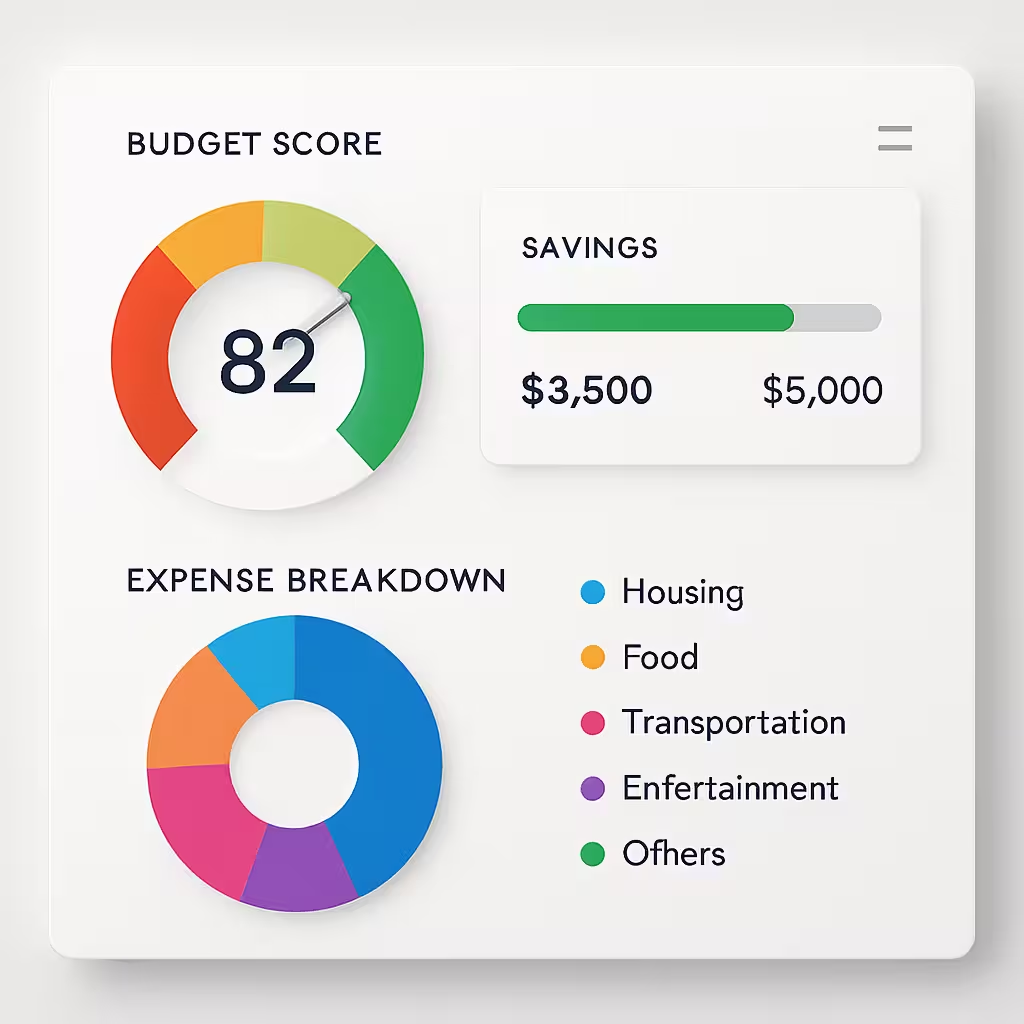

A financial health tool is an online calculator or app that checks your money habits, savings, debts, and goals. It gives an instant assessment—usually through a score or progress bar—telling you how healthy your finances are. Most modern tools are easy to use, mobile-friendly, and give recommendations to help you improve.

Using one is simple:

- Enter your income.

- Add your regular expenses.

- Put in any loans, EMI, or credit card payments.

- Set your savings amount and goals.

The tool processes this data and shows results right away. I personally use mine every month to track how my choices are affecting my future.

My Personal Experience

After using a financial health calculator for three months, I noticed substantial changes. My spending dropped because I could easily spot where I wasted money. I started saving more, simply because the tool reminded me to set money aside before spending.

One feature I love is the ‘goal setting’ part. When I set a goal, for example, saving ₹50,000 for travel, the tool tracks my progress. Each month, I see how close I am and what adjustments I should make. It feels rewarding and keeps me motivated.

But most importantly, my stress has decreased. Instead of worrying if I can pay bills or afford surprises, I know exactly what my budget looks like and can handle emergencies.

Top Benefits of Financial Health Assessment

Wondering if a financial health tool is right for you? Consider these key benefits, all supported by my experience and expert advice:

1. Clear Picture of Your Finances

No more guessing. The tool gives you a single score or easy graphic showing your financial health. You will see where you stand instantly.

2. Find Weak Spots

You are spending too much on food delivery, or you forgot about an old subscription. This tool points these out, helping you plug leaks.

3. Set Achievable Goals

Most tools let you plan for goals—whether it is saving for a car, buying a laptop, or handling emergencies. Progress tracking keeps you focused.

4. Monthly Monitoring = Fewer Surprises

Life changes fast. By checking your financial health monthly, you spot problems early and catch opportunities to save.

5. Less Stress, More Freedom

Money worries are common, but they do not have to be. Regular assessments make you confident, not anxious.

6. Tailored Advice

Some advanced calculators even suggest investment options, track your debt-to-income ratio, and offer tips for better habits.

Why Use a Financial Health Calculator in 2026?

This year has already seen new financial products, rising costs, and faster ways to pay and borrow. Keeping up is hard—but tools are keeping pace.

- Fast Loading: Open the app, enter your details, and get instant answers.

- Mobile Responsive: Check budgets and savings anywhere—at home, in line, or traveling.

- Data Privacy: The best tools never share your information.

- User-Friendly Design: No technical jargon—amazingly simple numbers, simple steps, and progress bars you understand.

When I began using a financial health tool, I found myself spending smarter. For example, after tracking my restaurant bills, I started cooking at home twice a week—which saved me money for my travel funds.

Features to Look For

While choosing your financial health calculator, check these key features:

- Budget Planning: Helps you set monthly targets and stick to them.

- Debt Management: See how loans or EMI payments affect your net worth.

- Investment Advice: Many offer tips based on your goals and risk tolerance.

- Goal Progress Tracking: Know, month by month, if you are moving toward your target.

- Reports and Graphs: Visual summaries make it easy to share with family or keep your records.

- Emergency Fund Checker: Tells you if you are prepared for surprises, like health bills or car repairs.

The 2026 Advantage: Next-Level Tools

In 2026, financial tools have become smarter and faster. Many now use AI to personalize recommendations. For example, after I used my tool for a few months, it started suggesting ways to cut bills—like switching energy providers or changing insurance plans.

These new features are not just for finance experts. Everyone from college students to retirees can benefit. The more you use the tool, the smarter it becomes, giving even better advice over time.

Staying Ahead in a Changing World

Prices can rise, jobs can change, and emergencies can strike at any time. A financial health tool helps you stay one step ahead by:

- Tracking routine and unexpected spending

- Alerting you to risky habits

- Helping you increase your savings bit by bit.

- Offering peace of mind even when the world feels unpredictable.

I check mine monthly, and it has become as normal as brushing my teeth. It is a small, five-minute habit with big rewards.

Frequently Asked Questions

Why do I need a financial health tool in 2026?

Financial tools make money management simple and remove surprises. You will get clear guidance for saving, spending, and planning.

Does it take a lot of time to use?

No. Most take less than 10 minutes a month, and the benefits last all year.

Are my details safe?

Leading calculators use strong security protocols to keep your data private.

Can anyone use these tools?

Yes. Today’s tools are design for all ages and income levels—with advice tailored to your situation.

Can I use the tool offline?

Many let you download reports or use app features even when the internet is down.

Easy Steps to Get Started

- Pick a trusted financial health calculator (look for high ratings or recommendations).

- Gather your financial info (salary, expenses, debts, savings).

- Fill in the details—the tool does the rest.

- Review the results, follow suggestions, and repeat monthly.

Internal Links for a Better Financial Journey